BUSINESS &ECOMONY

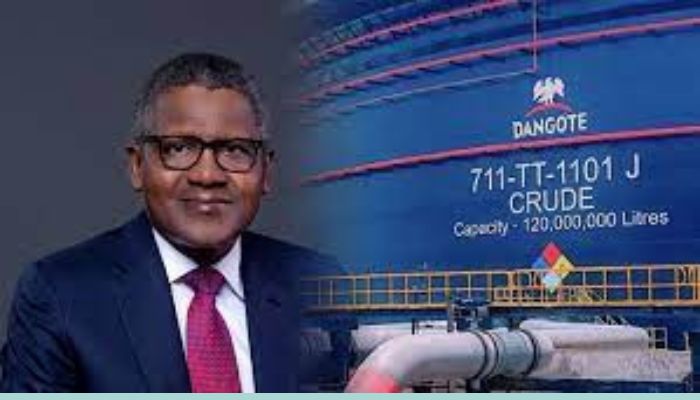

OIL TRADE IRONY: INDIA BUYS NIGERIAN CRUDE, DANGOTE TURNS TO US OIL

In a twist that feels almost like a plot from a global trade satire, India’s state-owned refineries are snapping up Nigerian crude oil, while Nigeria’s very own mega-refinery, the $20 billion Dangote Petroleum Refinery, is relying heavily on oil from the United States.

According to industry reports, Indian Oil Corporation recently bought a million barrels of Nigeria’s Agbami crude for September delivery. This is part of a bigger shift, as Indian refiners have been diversifying away from Russian supplies under pressure from the United States. By September and October, over two million barrels of Nigerian crude will be sailing to India.

But here’s the twist while India is taking in Nigerian oil, the Dangote Refinery in Lagos is filling most of its tanks with US crude. Data from commodity analytics firm Kpler shows that in July, 60% of Dangote’s crude intake came from the US, with Nigerian grades making up the other 40%. This marks the first time American barrels have overtaken local supply at the refinery.

Why? Industry analysts say US oil, especially West Texas Intermediate (WTI), has been competitively priced, and finding enough Nigerian crude for the refinery has been a challenge. Dangote has been outspoken about the difficulty of securing a domestic supply despite an agreement with the Federal Government.

Still, Dangote’s refinery is running at 85% of its capacity, churning out gasoline, jet fuel, and other products for domestic use and export. The company even claims Nigeria is now a net exporter of refined products, having shipped about 1 million tonnes of petrol in just 50 days.

However, operational challenges remain. Some refinery units have faced mechanical issues since January, and analysts caution that running at full capacity consistently might not happen until late 2026.

Meanwhile, Nigeria’s crude output is steady at around 1.75 million barrels per day, thanks to better onshore stability and fewer pipeline disruptions. Indigenous oil companies are increasingly taking the lead, with new infrastructure like the privately built Otakikpo terminal making its first export in June.

The irony is hard to miss: Nigeria’s oil is fueling India’s refineries, while Nigeria’s biggest refinery is banking on American oil to keep its operations running smoothly.

In the world of energy, it seems geography matters less than price, availability, and politics, and Nigeria’s oil story is a perfect example of this global balancing act.

"This represents a significant development in our ongoing coverage of current events."— Editorial Board